Energy Transfer moves big with MidOcean Energy

This deal is a gamechanger and another promising outlook on America's LNG future

A couple of days ago, Energy Transfer dropped a bombshell with their press release, revealing that MidOcean Energy, backed by EIG’s deep pockets, is taking an equity stake in Lake Charles LNG. I see this as a power move to push the project toward a final investment decision (FID). The facility, greenlit for exports back in 2016, has been stuck in limbo, but this partnership could be the spark it needs. Tom Mason, Energy Transfer’s President, said it best: “We are pleased to have MidOcean partner with us on our Lake Charles LNG project and we believe its participation will provide a significant catalyst towards reaching positive FID.” With MidOcean’s LNG savvy and Energy Transfer’s massive pipeline network, I’m betting this project is about to hit warp speed.

Louisiana’s LNG scene is red-hot right now-- in one of my recent pieces, “Stonepeak’s $5.7B Stake in Louisiana,” I highlighted how private equity is pouring billions into the state’s energy projects. As I noted, Stonepeak’s massive investment underscores Louisiana’s emergence as a global LNG hub, with its strategic Gulf Coast location and access to abundant natural gas reserves. Energy Transfer’s deal fits right into this trend--big players are betting on Louisiana to dominate the global LNG market.

The timing couldn’t be better, thanks to some recent policy wins I’ve covered. In “DOE Ditches LNG Export Deadlines,” I broke down how the Department of Energy scrapped those pesky export timelines that were holding projects back. As I mentioned, the DOE’s decision to scrap these arbitrary timelines removes a bureaucratic hurdle, allowing projects like Lake Charles to proceed based on market realities rather than regulatory whims. For Energy Transfer, this means more runway to get Lake Charles, with its planned 16.5 million tons per annum (MTPA) capacity, off the ground.

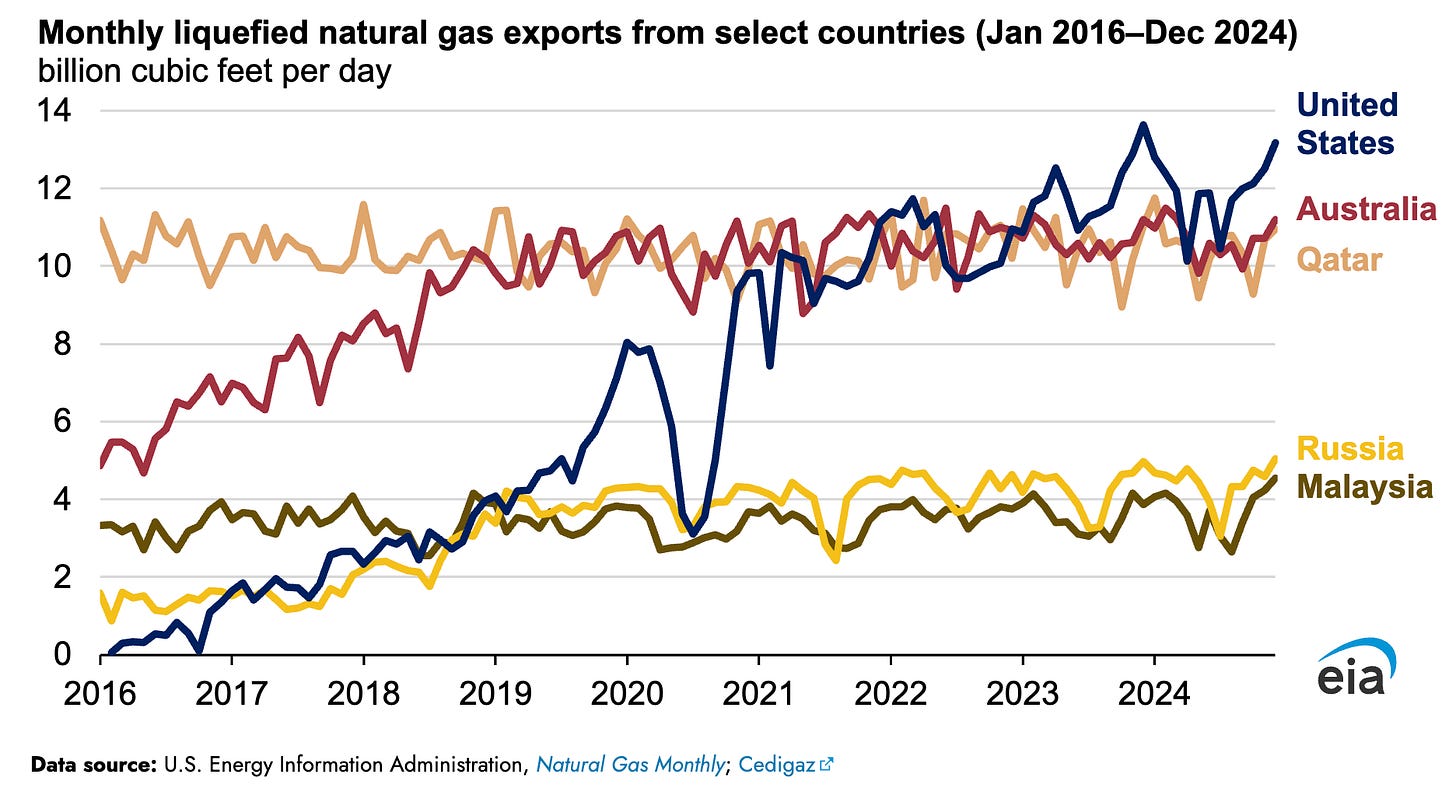

I’ve also been clear about America’s LNG dominance, as I detailed in “U.S. Solidifies Its Spot as the World’s Top LNG Exporter.” I noted in 2024, the U.S. overtook Qatar and Australia to become the world’s top LNG exporter, with facilities like Cheniere’s Sabine Pass and Freeport LNG leading the charge. Once Lake Charles comes online, I’m convinced it’ll add serious muscle to the U.S. export machine, feeding hungry markets in Europe and Asia.

That said, the road hasn’t been smooth, and I’ve called out the political roadblocks along the way. In “Biden’s LNG Study Suppression Undermined,” I dug into the Biden administration’s 2024 LNG export permit pause, which I argued was more about optics than science. I wrote that the administration’s attempt to suppress LNG growth through questionable studies fell apart when the science didn’t align with their narrative. That pause got lifted, thankfully, and since Lake Charles already had its approvals, it dodged the worst of the fallout. Still, it’s a reminder of how politics can mess with progress.

This MidOcean deal has me fired up because it shows Energy Transfer doubling down on LNG at the perfect moment. Global demand is projected to jump 50% + by 2040, and I see Lake Charles becoming a cornerstone of that growth. By teaming up with MidOcean, Energy Transfer is blending their infrastructure clout with LNG market smarts. As I’ve said before, Louisiana’s LNG boom is a testament to American ingenuity and market-driven energy solutions. This partnership is proof of that, and I’m excited to keep watching--and writing--as it unfolds.

Great news. You're getting me fired up too.